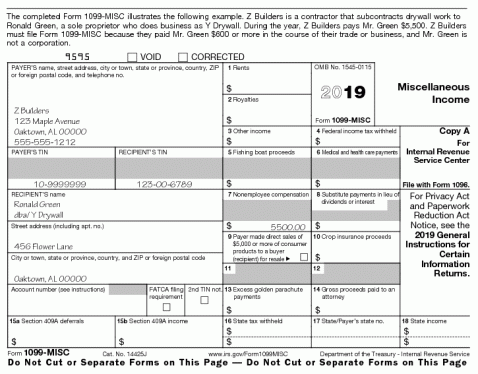

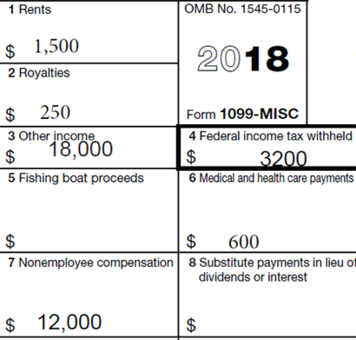

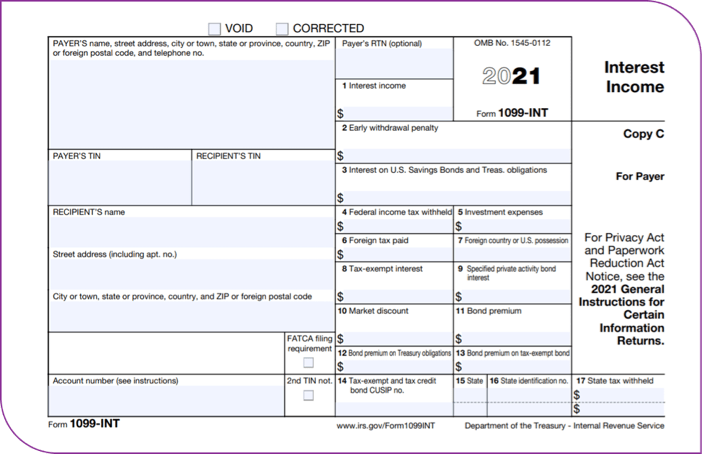

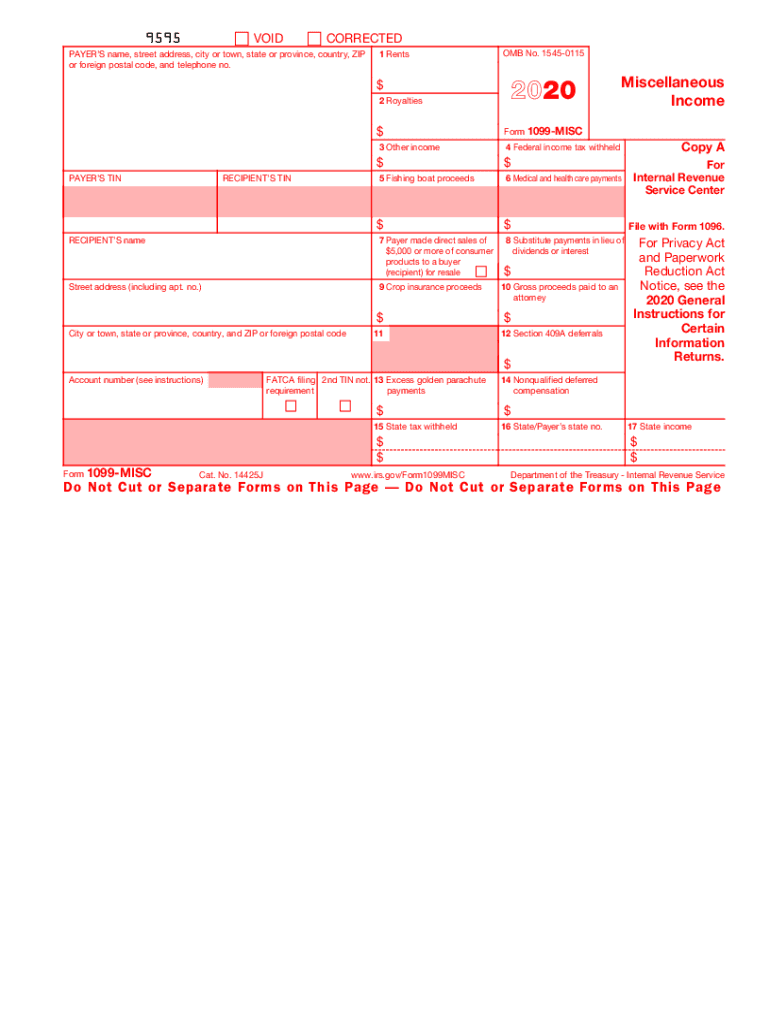

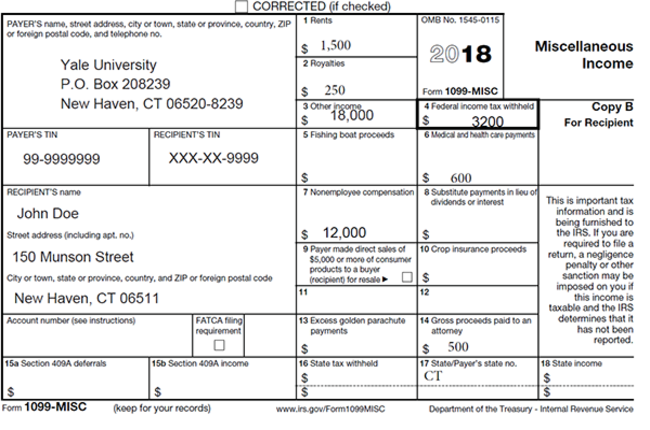

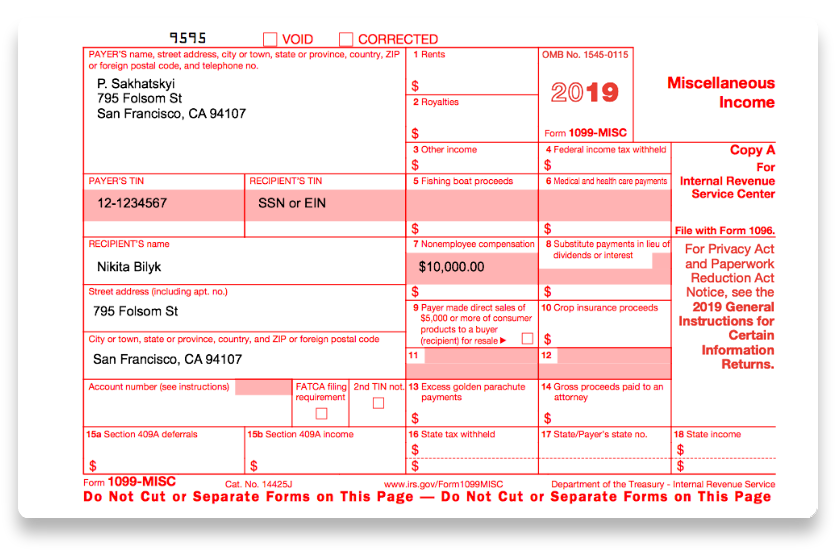

Independent contractors handle taxes related to social security, medicare etc Employers have to produce a W9 to be completed by the independent contractor You may have to file information returns (form 1099MISC) to report certain types of payments made to independent contractorsA freelance (independent contractor) invoice is a document that allows any contractor providing any type of service, from gardener to architect, to provide their clients with an itemized statement of services rendered The contractor may choose to provide billing for payment at the time of service or they may choose to provide billing in specified incrementsPayer is reporting on this Form 1099 to satisfy its account reporting requirement under chapter 4 of the Internal Revenue Code You may also have a filing requirement See the Instructions for Form 38 Amounts shown may be subject to selfemployment (SE) tax Individuals should see the Instructions for Schedule SE (Form 1040) Corporations,

What Is A 1099 Misc Stride Blog

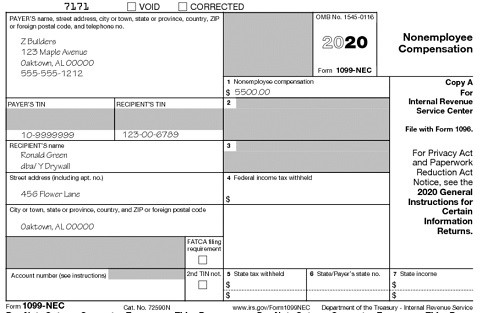

1099 form independent contractor example

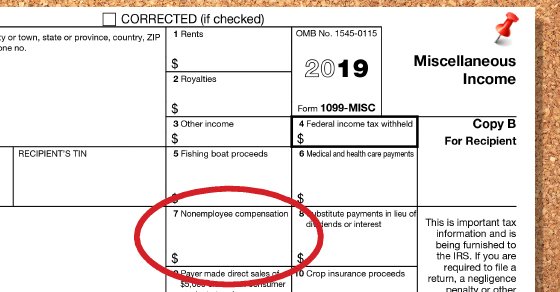

1099 form independent contractor example-A The form is used to report payments of at least $600 to any service provider (ie, contractor, freelancer, consultant) who isn't an employee If the service provided was less than $600, you don't need to file a 1099MISC One monthly payment of $300 wouldn't require you to file the form, for example A 1099 Contractor is a name given to selfemployed individuals who trigger the need for a company to issue a Form 1099MISC to document earnings paid to this person for services rendered, beyond $599 An independent contractor is a nonemployee of the company

What Is The Difference Between A W 2 And 1099 Aps Payroll

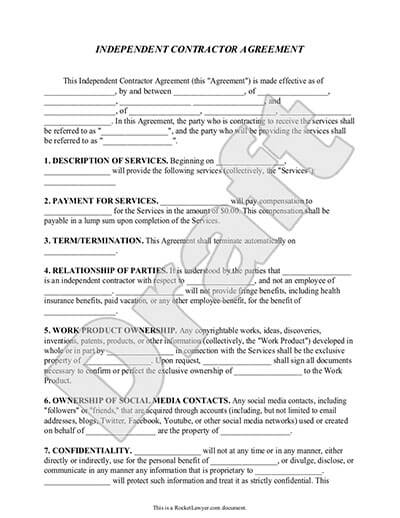

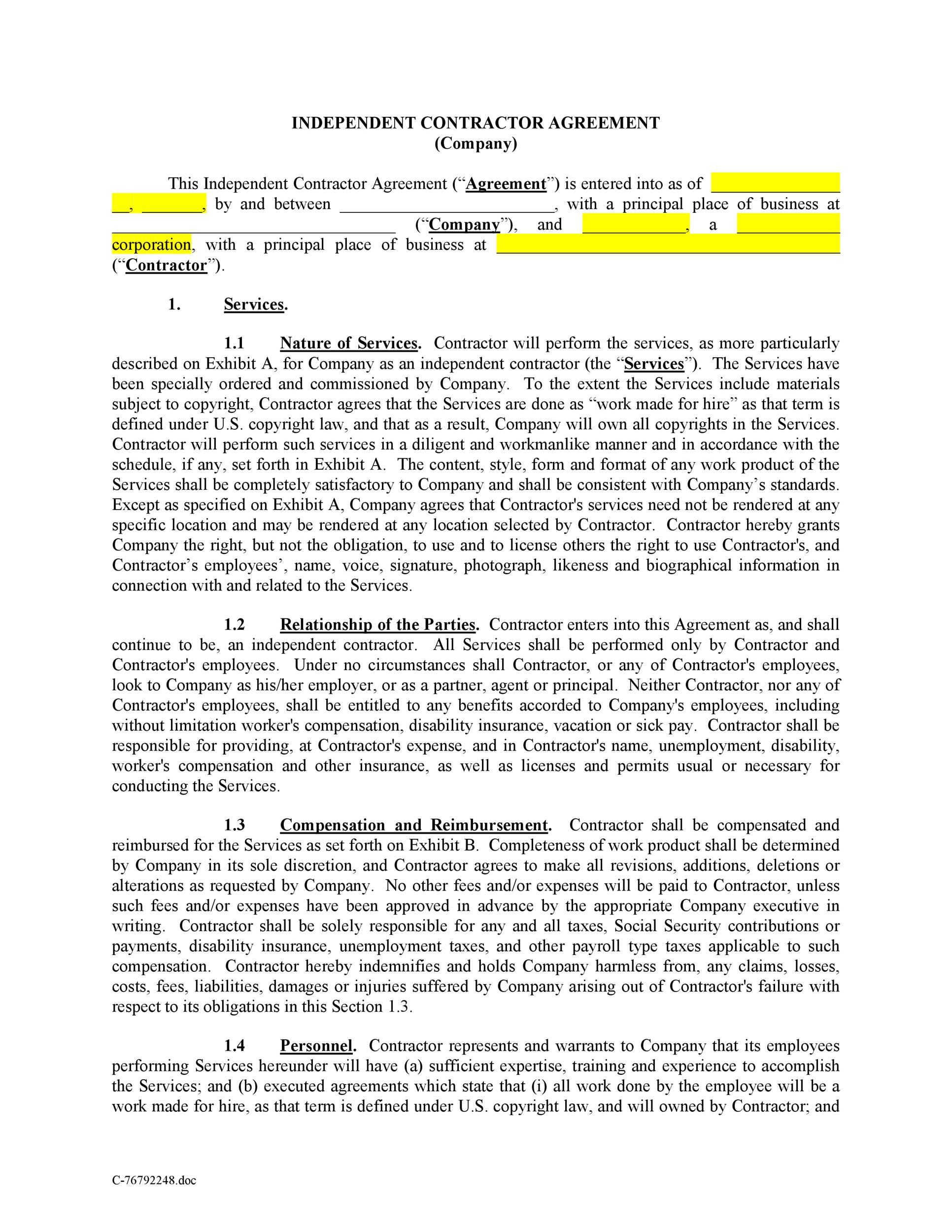

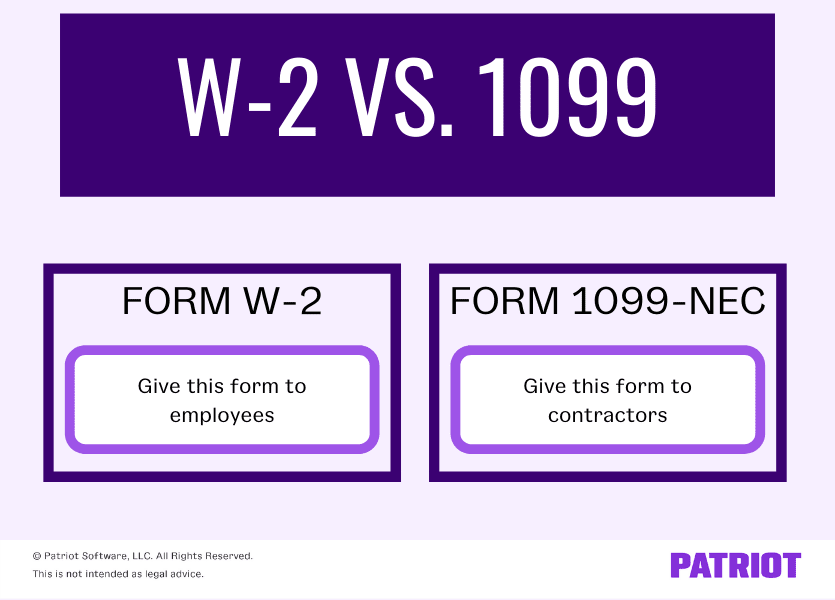

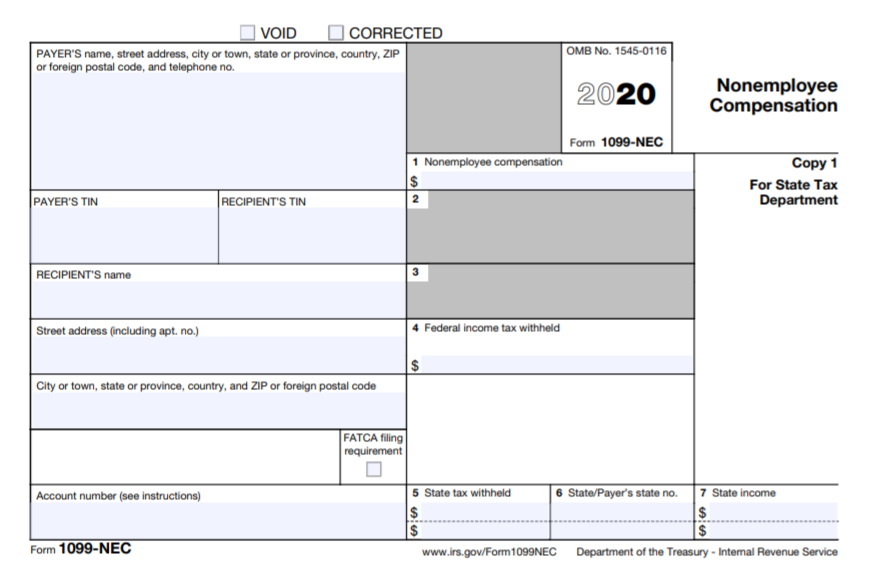

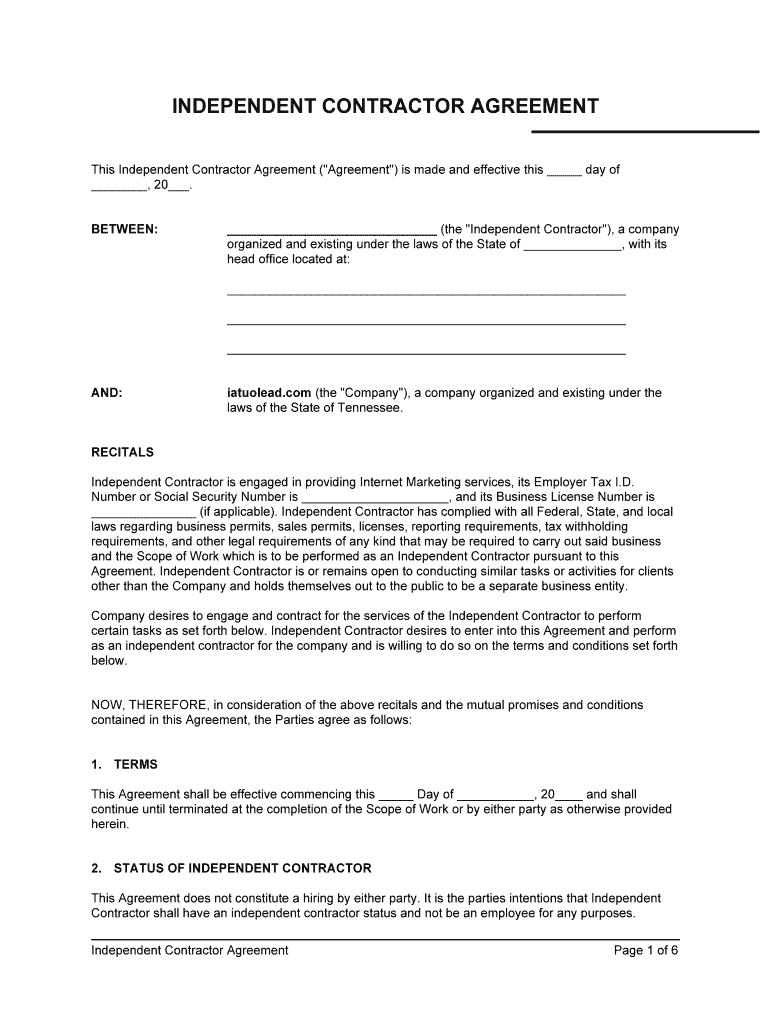

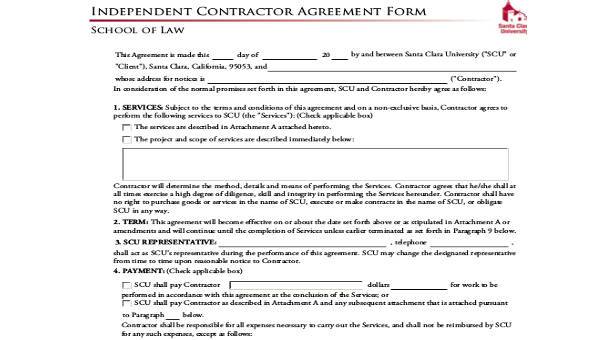

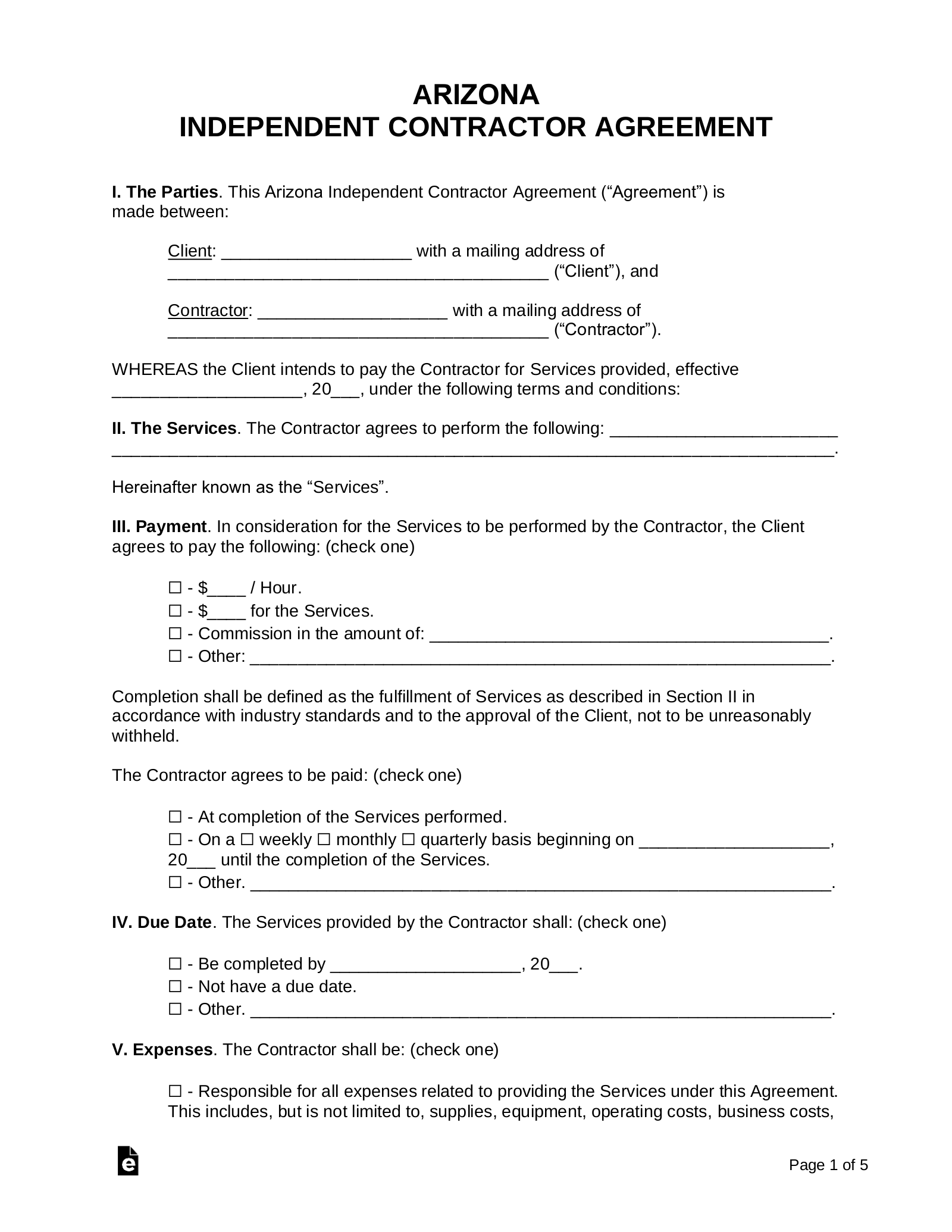

1099 CONTRACTOR AGREEMENT AGREEMENT made as of _____, between Eastmark Consulting, Inc, a Independent Contractor The relationship between Contractor and Eastmark is that of an in tangible form shall be returned immediately to the disclosing party Following the termination of1099 Form Independent Contractor Printable – A 1099 form reports certain kinds of income that tax payers have earned during the year A 1099 form is crucial because it's used to record nonemployment income earned by a taxpayer Whether it's cash dividends paid by a company that owns a stock or interest accrued from a bank account, a taxfree 1099 can be issued 1099 Form Independent Forms 1099 and W2 are two separate tax forms for two types of workers Independent contractors use a 1099 form, and employees use a W2 For W2 employees, all payroll taxes are deducted automatically from the paycheck and paid to the government by the employer Contractors are responsible for paying their own payroll taxes and submitting them

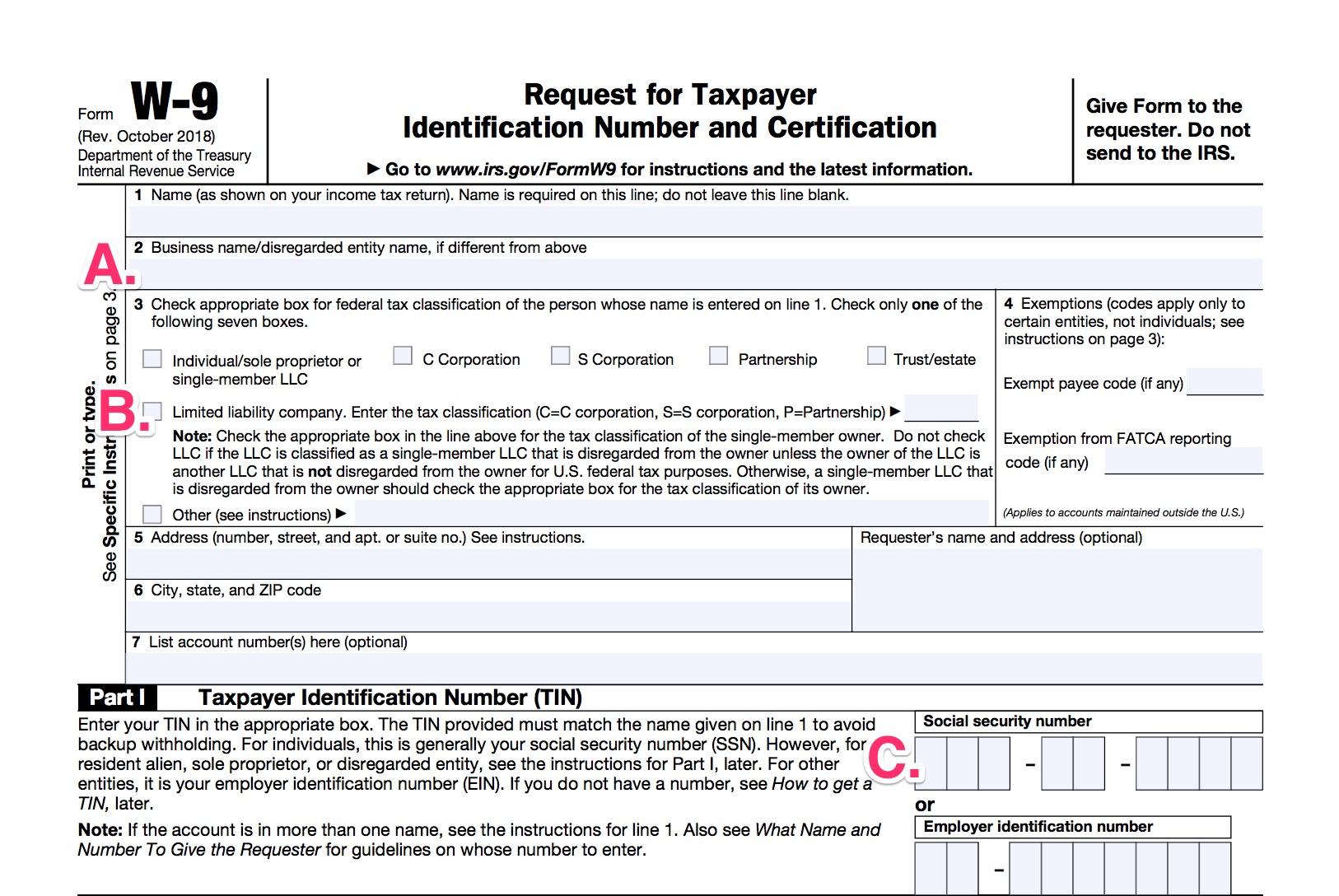

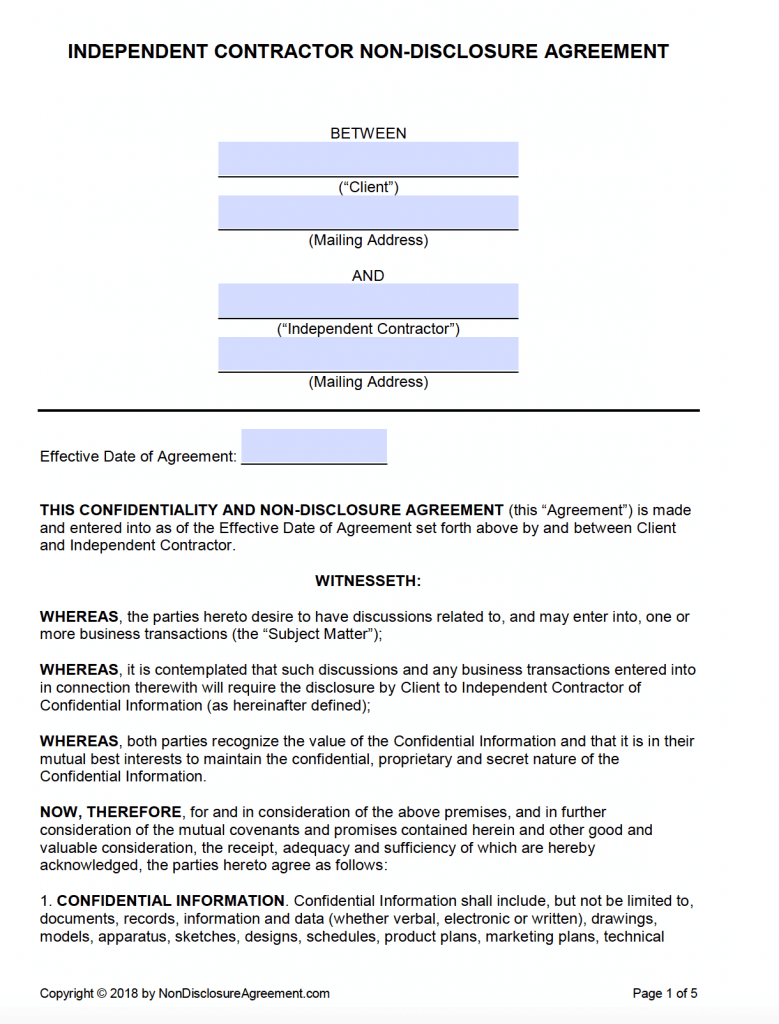

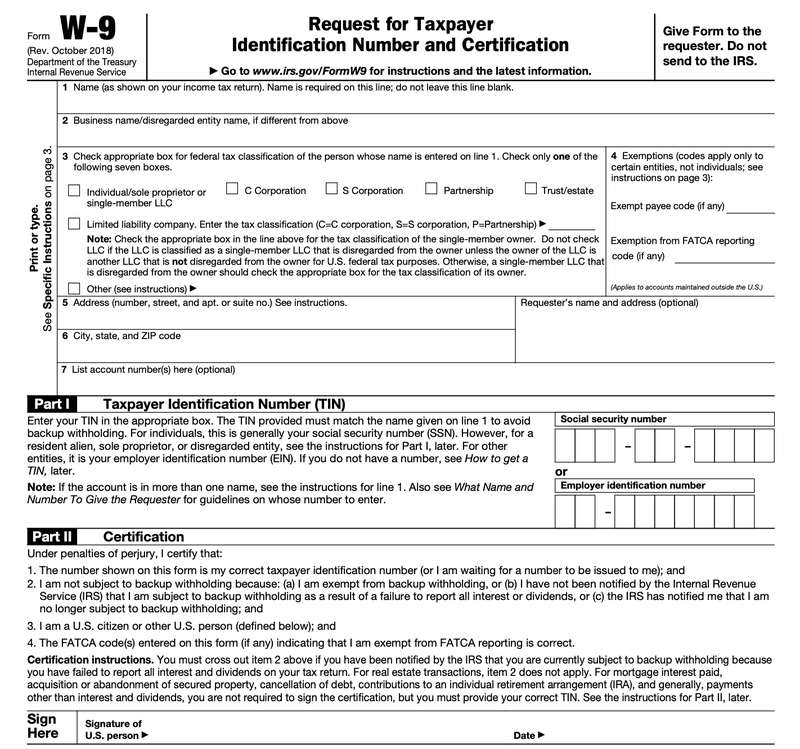

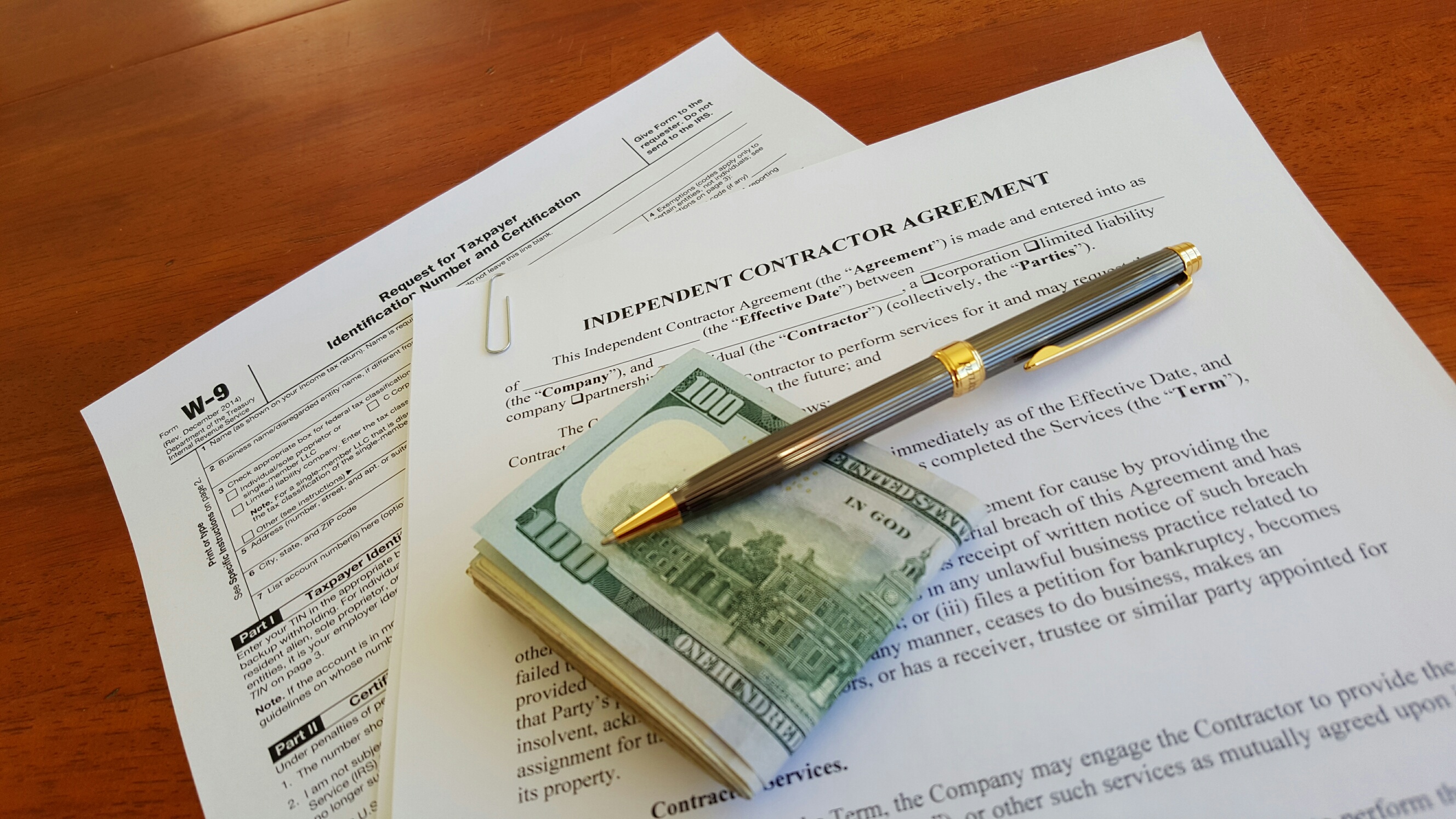

Client will not require Contractor to rent or purchase any equipment, product, or service as a condition of entering into this Agreement 5 Independent Contractor Status Contractor is an independent contractor, and neither Contractor nor Contractor's employees or contract personnel are, or shall be deemed, Client's employeesIndependent Contractor with a tax Form 1099 at the end of each year documenting the amount paid to Independent Contractor The Company will not withhold any taxes, FICA, or other amounts from its payments to Independent Contractor 9 Obligations of Independent Contractor – Independent Contractor acknowledges and agrees The most important document you will need to hire freelancers and independent contractors is an Independent Contractor Agreement This outlines the terms of a deal between a client and contractor and makes the agreed terms legally binding It will also be necessary to have an IRS form W9 available when you begin the process of hiring a contractor

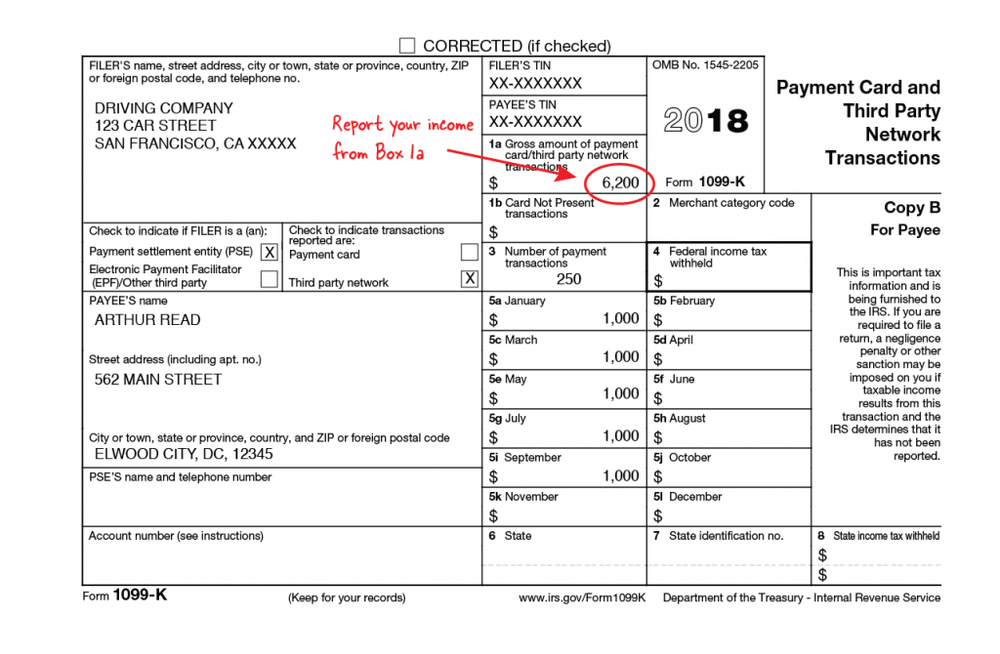

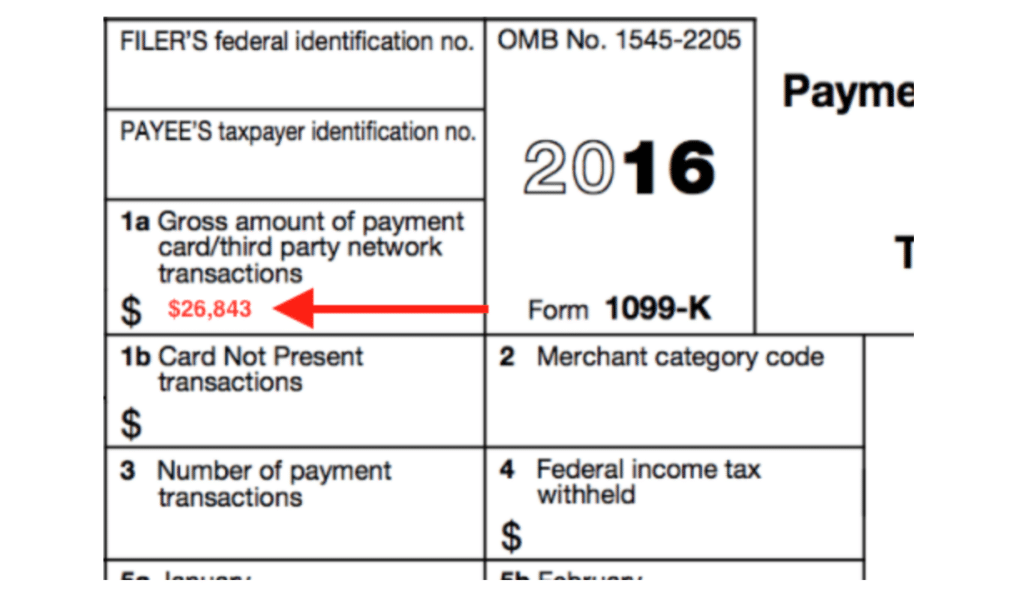

However, that same independent contractor would be on the temp agency's payroll and would be taxed as a W2 employee by the temp agency This is an example of an independent contractor receiving both a 1099 form and a W2 form from different companies for the same work Giving An Independent Contractor W2 Status Payments through thirdparty networks, including credit card payments, are reported on Form 1099K If, for example, a business pays an independent contractor through PayPal, the contractor may receive a Form 1099K from PayPal for those direct sales Issuing a 1099K depends on the number of transactions and the total dollar amount paidThe independent contractors need to report these payments on their tax returns as well For example, if you hire a website developer on a contract basis to develop a website for your business and paid $00 for their services, then you must report the $00 payment to the website developer on Form 1099MISC

Free Independent Contractor Agreement Template 1099 Pdf Word Eforms

Independent Contractor Agreement Example Word Document Short Form Texas

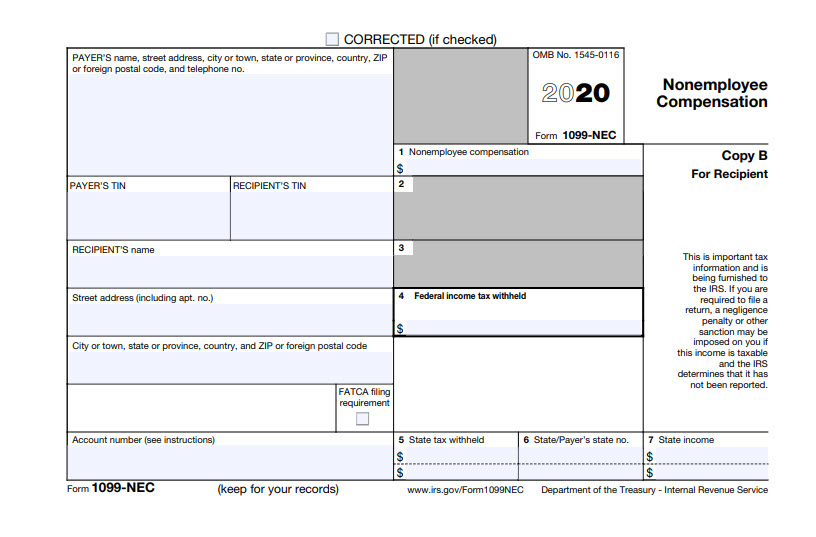

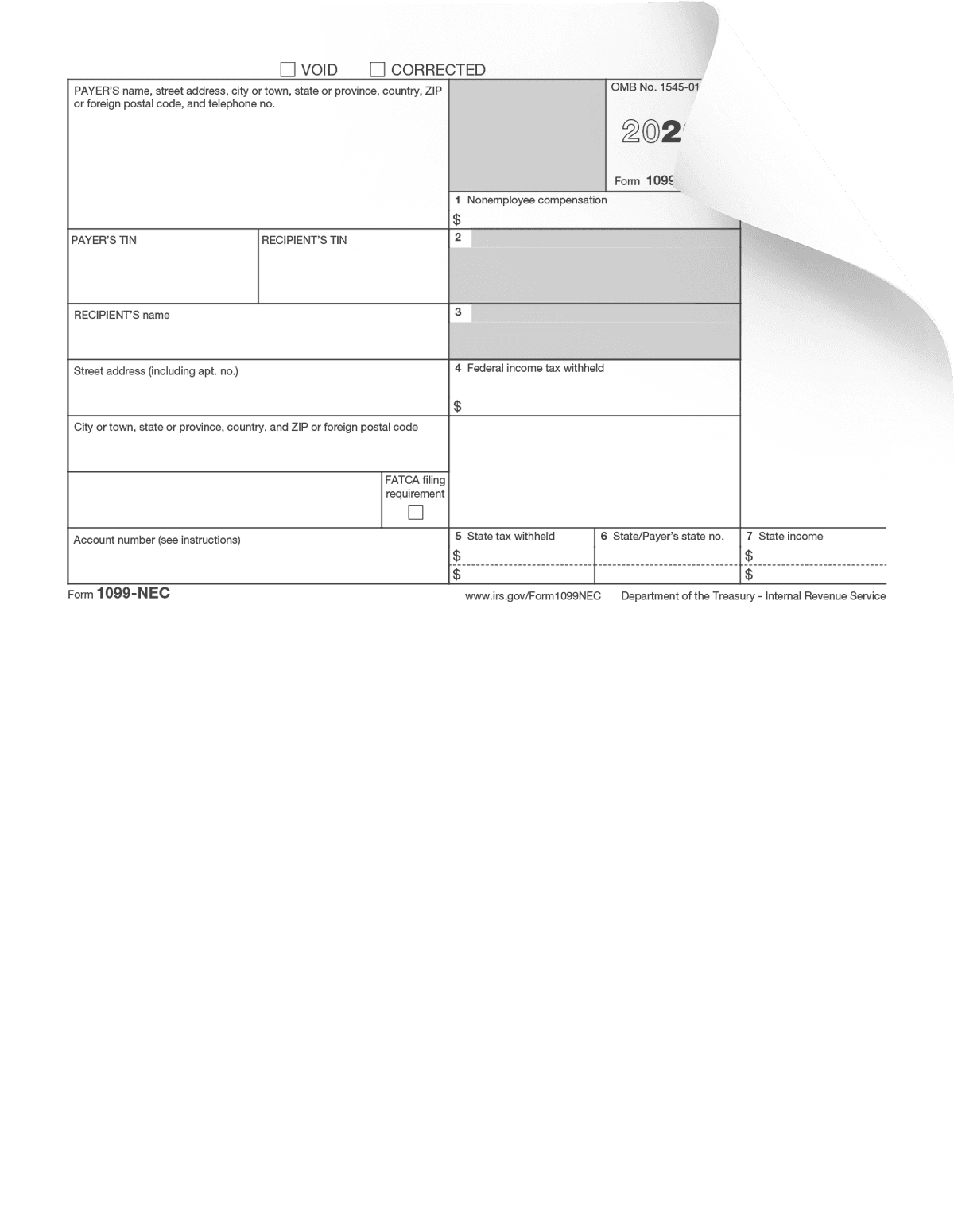

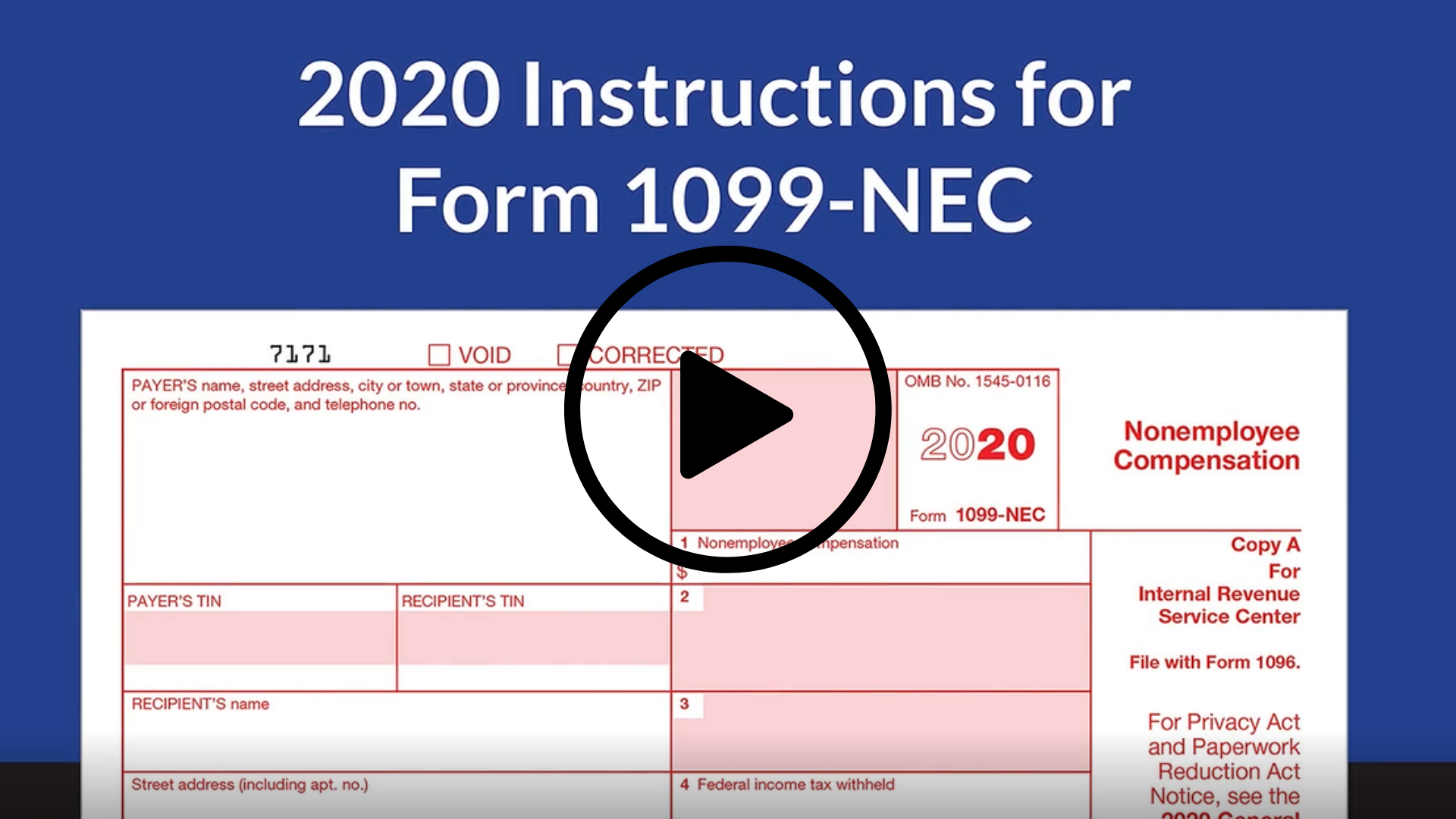

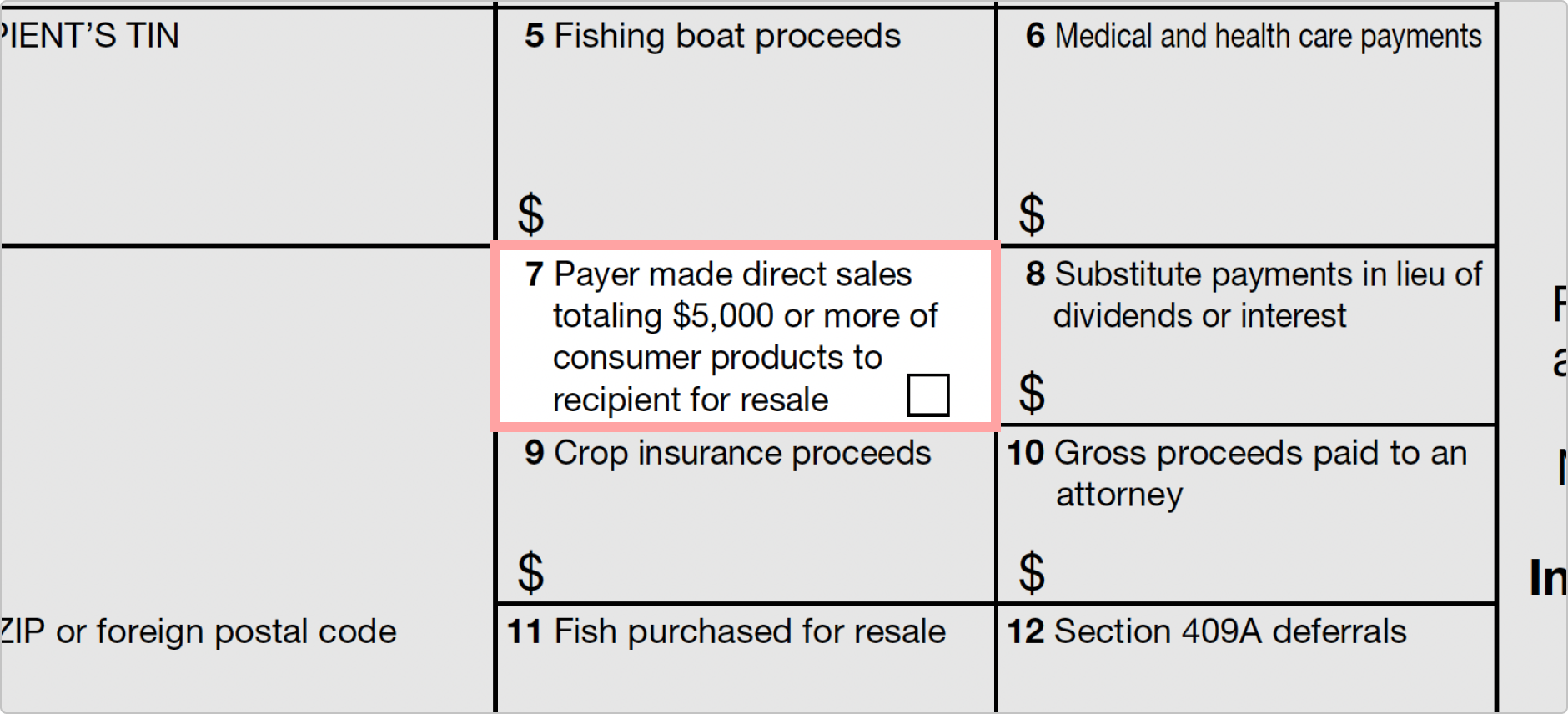

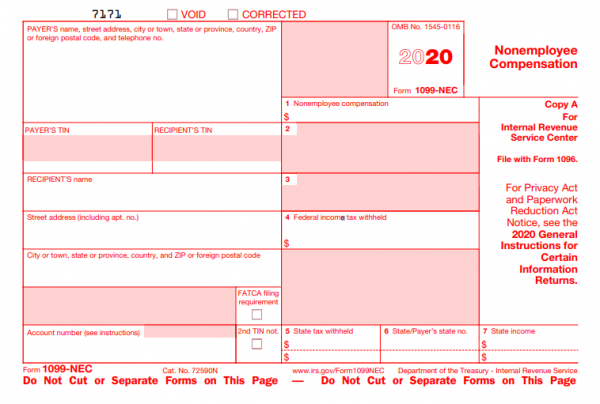

If you hire an independent contractor, you will be required to fill out a Form 1099NEC if you pay them more than $600 within a year The 1099NEC is needed to report how much income an independent contractor earns in a year You must send all completed 1099 forms to the IRS before January 31 of the following yearGet Great Deals at Amazon Here http//amznto/2FLu8NwIRS Order Forms https//bitly/2kkMEkkHow to fill out 1099MISC Form Contract Work Nonemployee Compens When you work with a 1099 independent contractor, do not withhold taxes Instead, you will provide IRS Form 1099NEC to each applicable independent contractor so that they can report their income on their tax return Give Form 1099NEC to contractors you paid $600 or more during the year

What Is A 1099 Employee The Definitive Guide To 1099 Status Supermoney

1099 Form Independent Contractor Download

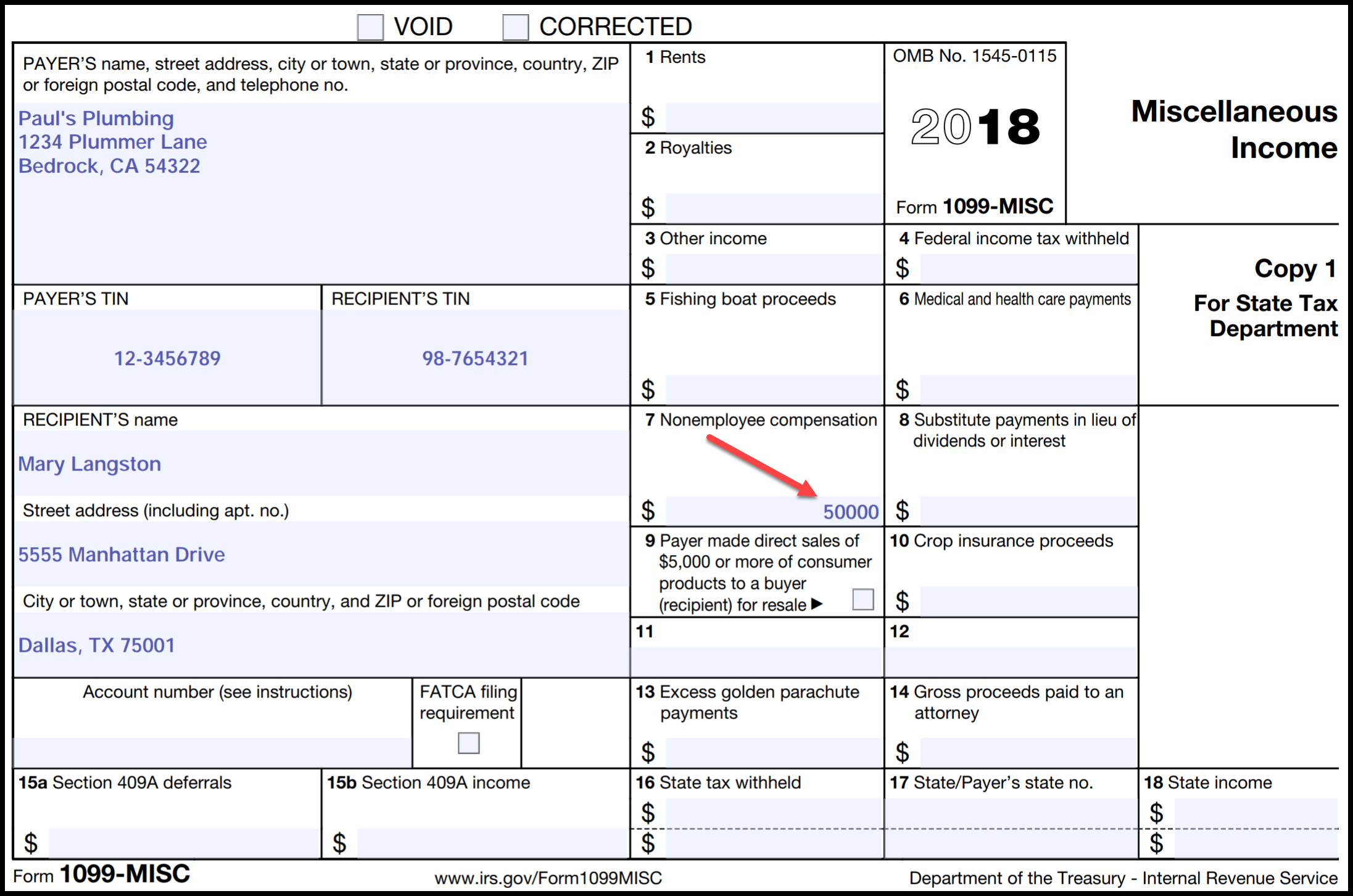

Q What is the purpose of the Form 1099MISC?CONTRACTOR in his/her professional capacity to provide sales &/or marketingrelated services CONTRACTOR shall be an independent contractor and shall be solely responsible for payment of all taxes and/or insurance as required by federal and state law 2 PERIOD OF PERFORMANCE Either party may terminate this agreement upon notice to the otherIRS 1099MISC Form – To be filed by the payor of an independent contractor of any individual that was paid more than $10 in royalties, $600 in payments, or $5,000 of a buyer for resale Contractor Work Order – An outlined request that is made prior to a job being assigned that gives a quote of the costs attributed to the labor and materials associated with the work

Free Independent Contractor Agreement Free To Print Save Download

Walk Through Filing Taxes As An Independent Contractor

Form 1099MISC vs Form 1099NEC In the past, businesses had to use Form 1099MISC to report independent contractor payments in addition to the other types of miscellaneous income However in , the IRS brought back Form 1099NEC, Nonemployee Compensation, to report nonemployee compensationBusiness owners used to report nonemployee compensation on Form 1099 The 1099 and W2 tax forms are used to deduct payroll taxes from various kinds of workers Employees with a 1099 status are selfemployed independent contractors They are paid according to the terms of their contract and get a 1099 form on which toIRS Form 1099 – To be filed with the IRS at the end of the year if the payer paid an independent contractor $600 or more Must be filed by January 31st following the calendar year Must be filed by January 31st following the calendar year

What Are Irs 1099 Forms

3

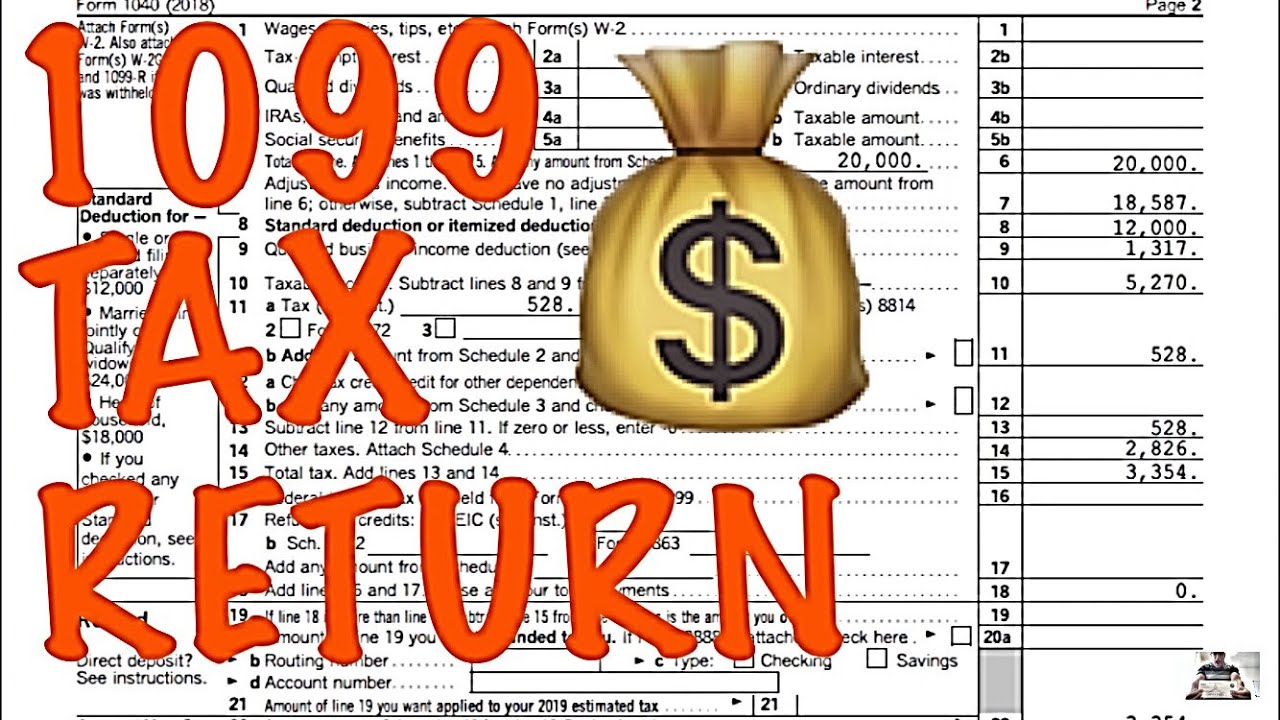

Form 1099NEC, Nonemployee Compensation Taxpayers who are independent contractors should receive Form 1099NEC showing the income they earned from payers who are required to file Forms 1099 The use of Form 1099NEC to report payments to independent contractors is new for The amount from Form(s) 1099NEC, along with any otherSince the IRS considers any 1099 payment as taxable income, you are required to report your 1099 payment on your tax return For example, if you earned less than $600 as an independent contractor, the payer does not have to send you a 1099MISC, but you still have to report the amount as selfemployment income 1099 is a tax form for independent contractors, and independent contracts are not employees If you've heard the phrase "1099 employee," it is an oxymoron–there are no 1099 employees Independent contractors do not have many of the rights guaranteed to employees under federal and California state laws

Printable Form 1099 Misc 21 Insctuctions What Is 1099 Misc Tax Form

New Form 1099 Reporting Requirements For Atkg Llp

You are wise to get this agreement signed with independent contractors to protect your interests in any IRS audit It serves to document the provider's role as a 1099 contractor as opposed to being an employee 1 Make multiple copies Put one in the file kept for the individual service provider and another in your accounting files The 1099 Form, Explained and Annotated When you're a small business owner issuing tax forms to an individual, there are two different forms you can use If the person in question is your employee, you fill out a W2 form If the person isn't your employee, however—if they're an independent contractor, for example—you fill out a 1099 By definition, an independent contractor is not an employee Common examples include graphic designers, web developers, copywriters, and social media consultants If you hire a freelancer through a thirdparty service, you may not be required to submit a 1099 for them

3

What Are Irs 1099 Forms

Employees who only get commissions are called 1099ers due to the 1099MISC form that they receive every year This is different from the W2 forms that salaried and hourly employees get What are Independent 1099 Sales Representatives? independent contractor shall be responsible for providing all tools and materials required for performance of the tasks agreed to independent contractor is responsible for payment of all federal, state and local income taxes dated _____ _____ contracting party by an authorized officer _____ independent contractor agreement for independent You have to file IRS Form 1099 to report taxes on payments to independent contractors This needs to be done for every independent contractor to whom you've paid at least $600 for services, and can be done easily with a Form 1099MISC builder Sample Independent Contractor Agreement

Understanding Taxes Tax Tutorial Payroll Taxes And Federal Income Tax Withholding

What Is A 1099 Form And How Do I Fill It Out Bench Accounting

Simply use the postal mailing feature to have TaxBandits print and mail hard copies of Form 1099NEC to each of your recipientsAn Independent Contractor Agreement is a written contract that spells out the terms of the working arrangement between a contractor and client, including A description of the services provided Terms and length of the project or service Payment details (including deposits, retainers, and other billing details)A legal contractor is someone who does the following Controls when and how customers are seen

What Is A 1099 Contractor With Pictures

Independent Contractor Agreement Template Free Pdf Sample Formswift

The independent contractor nondisclosure agreement is intended for use with workers (sometimes known as "1099 contractors" because of their tax status) who perform tasks for you or your business Unlike employees, independent contractors are not bound to maintain secrecy under most state laws That is, if you disclose a trade secret to a contractor without a nondisclosureThe IRS provides specific and clear instructions on when a 1099MISC must be used For example, if you received at least $600 in rental income, you would use a 1099MISC If you paid a lawyer at least $600 for legal services of some kind for your business, you can send them a 1099MISC Simply put, independent contractors or 1099 contractors are hired by a client for a specific task The independent contractors control how and when they perform the task Some examples of independent contractors include plumbers, writers, photographers and consultants

Form 1099 Nec Form Pros

Instructions For Forms 1099 Misc And 1099 Nec Internal Revenue Service

Download the independent contractor invoice template to formally request payment for most any type of independent contracting work This includes freelance home repair, graphic design, writing, and much more Be sure to accurately describe the work you performed and the charges being applied IRS 1099MISC Form – Filed by an independent contractor at the end of the year if For example, you can save time by using the bulkupload feature to import all of your independent contractor information at once Also, forget about heading to the post office! Independent Contractor and Statutory Employee You might be both an independent contractor and employee at the same time As a statutory employee, you will receive periodic paychecks and, for each tax year, a W2 from your employer(s) by January 31 of the following year If you also have independent contract income, that might be reported via one or more 1099

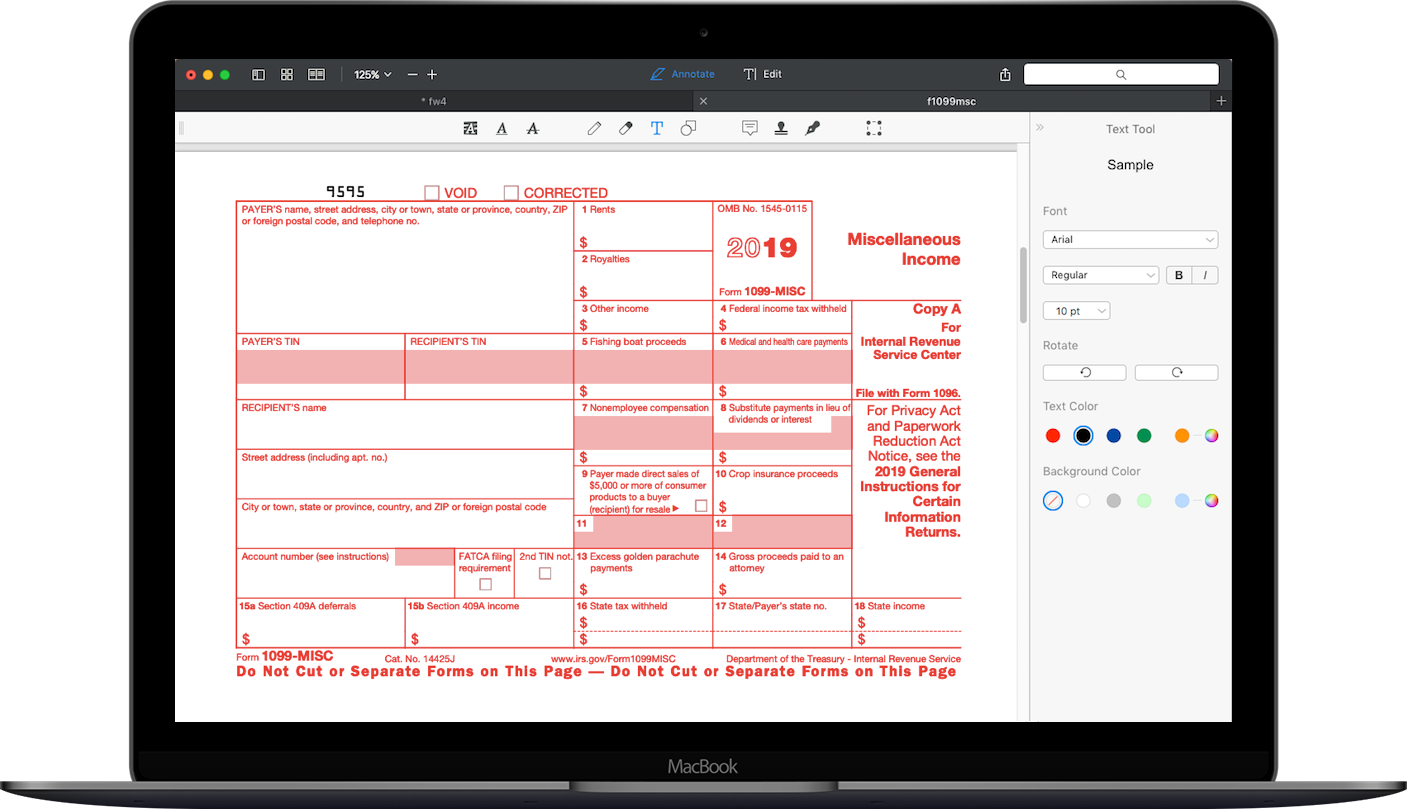

How To Fill Out Irs 1099 Misc 19 Form Pdf Expert

What Is The Difference Between A W 2 And 1099 Aps Payroll

Understanding 1099 Form Samples Oracle 6 hours ago This section provides a sample of the 1099DIV form, which you use to report dividends and distributions 1041 1099DIV Form SampleThese are examples of 1099DIV forms for 19 Figure 105 Example of the 1099DIV form for 19 Preprinted Version Show more See Also Sample 1099 form filled out ShowIndependent Contractor Agreement (1099) An independent contractor agreement is a contract between a client that pays a 1099 contractor for their servicesAn independent contractor is not an employee In most cases, an independent contractor is paid on a perjob or percentage (%) basis, not by the hour ($/hr)Independent Contractor Agreement Classified by the IRS as a 1099 Employee, is an individual or entity that is paid to perform a serviceExamples include contractors, medical professionals, attorneys, etc Download Adobe PDF, MS Word (docx), OpenDocument

Form 1099 Nec Instructions And Tax Reporting Guide

What Is The Account Number On A 1099 Misc Form Workful

1099 Misc Form Reporting Requirements Chicago Accounting Company

How To File A Tax Return With A 1099 Independent Contractor Tax Preparation Youtube

What Is Form 1099 Nec How Do I File Form 1099 Nec Gusto

What Tax Forms Do I Need For An Independent Contractor Legal Io

1099 Form Independent Contractor Agreement Unique 1099 Form Independent Contractor Agreement Example Forms For Models Form Ideas

How To File 1099 Misc For Independent Contractor

Instant Form 1099 Generator Create 1099 Easily Form Pros

Get Ready For The New 1099 Nec And Changes To 1099 Misc Filing W9manager

1099 Misc Form Fillable Printable Download Free Instructions

Create An Independent Contractor Agreement Download Print Pdf Word

W9 Vs 1099 A Simple Guide To Contractor Tax Forms Bench Accounting

50 Free Independent Contractor Agreement Forms Templates

Your Ultimate Guide To 1099s

/Form-1099-INT-f66ad58588f44ad6a46c69545056753a.jpg)

10 Things You Should Know About 1099s

:max_bytes(150000):strip_icc()/Clipboard01-f2dbf519c5934e4cb3d9baca6efe0ec7.jpg)

Form 1099 Misc Miscellaneous Income Definition

Form 1099 Vs W 2 Differences Rules More

:max_bytes(150000):strip_icc()/1099div-23bffa1db9074ba1b43bdd2cb4ece3ec.jpg)

Form 1099 Definition

Pin By Carole Pellegrino On Invoice Invoice Template Business Budget Template Invoice Template Word

3

1099 Misc Instructions And How To File Square

/Clipboard01-f2dbf519c5934e4cb3d9baca6efe0ec7.jpg)

Form 1099 Misc Miscellaneous Income Definition

Independent Contractor 101 Bastian Accounting For Photographers

:max_bytes(150000):strip_icc()/ScreenShot2021-02-06at1.17.00PM-ef62520d45364d5ea8a09564a54d5757.png)

Form 1099 R Distributions From Pensions Annuities Retirement Or Profit Sharing Plans Definition

1099 Form Independent Contractor Free

Dealing With Fraudulent Or Incorrect 1099 Robinson Henry P C

Ready For The 1099 Nec

How To Fill Out A W 9 19

1

Irs Form 1099 Reporting For Small Business Owners In

What Is A 1099 Misc Stride Blog

Introducing The New 1099 Nec For Reporting Nonemployee Compensation Asap Accounting Payroll

Independent Contractor Agreement Example

Diligent Recordkeeping Key To Surviving Tax Time For Self Employed Taxpayers Hackensack New Jersey Self Employed Tax Lawyer Samuel C Berger Pc

1099 Misc Form Fillable Printable Download Free Instructions

1099 Form Irs 18

Form 1099 Misc It S Your Yale

1099 Misc 14

Form 1099 Nec For Nonemployee Compensation H R Block

/1099-NEC-e196113fc0da4e85bb8effb1814d32d7.png)

How To Report And Pay Taxes On 1099 Nec Income

1099 Misc Form Fillable Printable Download Free Instructions

What Is The Difference Between A W 2 And 1099 Aps Payroll

Form Irs 1099 Nec Fill Online Printable Fillable Blank Pdffiller

How To Prepare Form 1099 Nec When You Employ Independent Contractors Quickbooks

Choosing 1099 Box Types 1099 Nec And 1099 Misc

50 Free Independent Contractor Agreement Forms Templates

1099 Form Independent Contractor Free

Form 1099 For Nonprofits How And Why To Issue One Jitasa Group

Form Irs 1099 Nec Fill Online Printable Fillable Blank Pdffiller

Free 9 Independent Contractor Agreement Forms In Pdf Ms Word

1099 Form Independent Contractor Agreement

1099 Form 19 Pdf Fillable

What Is A 1099 K Stride Blog

Freelancers Meet The New Form 1099 Nec

How To Make Sure Your 1099 Misc Forms Are Correct Cpa Practice Advisor

Form Irs 1099 Misc Fill Online Printable Fillable Blank Pdffiller

Form 1099 Misc It S Your Yale

1099 Form Independent Contractor Agreement

The New 1099 Nec Irs Form For Second Shooters Independent Contractors Formerly 1099 Misc Lin Pernille

How To Fill Out 1099 Misc Form Independent Contractor Work Instructions Example Explained Youtube

Download 1099 Forms For Independent Contractors Brilliant Fake Pay Stub Sample Elegant Fake Proof Insurance Templates With Models Form Ideas

Free Independent Contractor Agreement Create Download And Print Lawdepot Us

What Is A 1099 Form And How Do I Fill It Out Bench Accounting

Irs 1099 Misc Form Free Download Create Fill And Print Wondershare Pdfelement

Form 1099 K Wikipedia

Airbnb 1099 Forms Everything You Need To Know Shared Economy Tax

1099 Misc Form And Other Tax Forms Online Only At Stubcreator

How To File 1099 Misc For Independent Contractor

1099 Nec And 1099 Misc Changes And Requirements For Property Management

Guide To Creating A 1099 Pay Stub Check Stub Maker

1099 Forms Everything Businesses Contractors Must Know To Be Stress Free About Taxes

Independent Contractor Billing Template Beautiful 6 1099 Template Excel Exceltemplates Exceltemplates Invoice Template Word Invoice Template Invoice Example

Fill Out A 1099 Misc Form Thepaystubs

How To File 1099 Misc For Independent Contractor

An Employer S Guide To Filing Form 1099 Nec The Blueprint

Who Are Independent Contractors And How Can I Get 1099s For Free

A 21 Guide To Taxes For Independent Contractors The Blueprint

Printable Irs Form 1099 Misc For 15 For Taxes To Be Filed In 16 Cpa Practice Advisor

What If A Contractor Or Vendor Refuses To Provide A W 9 For A 1099 Politte Law Offices Llc

Adding 1099 Contractors To Your Practice How To Start Grow And Scale A Private Practice Practice Of The Practice

:max_bytes(150000):strip_icc()/how-to-report-and-pay-independent-contractor-taxes-398907-FINAL-5bb27d1846e0fb0026d95ba3.png)

Tax Guide For Independent Contractors

How To Fill Out Irs 1099 Misc 19 Form Pdf Expert

Independent Contractor Agreement Example

0 件のコメント:

コメントを投稿